Encouraging Regional Tourism – Which inbound markets will drive growth?

18/05/2013 Leave a comment

Over the period from 2000-01 to 2011-12 the number of short term international visitors to Australia has grown by 2.3% per annum on average[1]. The origin markets that are growing strongly have been mainland China (13.0% per annum), India (12.4% per annum) and the Middle East (7.4% per annum). These markets are also forecast to provide the strongest growth into the immediate future.

While Australia has done well to grow international demand in the face challenging circumstances the markets with the highest rate of growth may not necessarily benefit all sectors and regions.

A recent study conducted for Tourism Research Australia and Destination NSW examined fly in leisure purpose (holiday / vfr) visitors to Sydney and the extent to which they disperse for an overnight stay into regional areas of New South Wales. The summary report can be accessed here http://www.ret.gov.au/tourism/research/tra/Documents/SRR_NSW_Visitor_dispersal_from_Sydney_to_Regional_NSW_FINAL.pdf

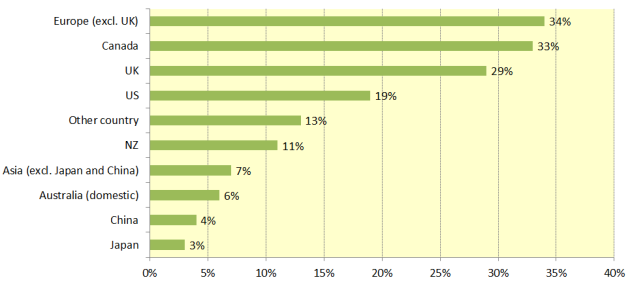

The proportion of visitors staying overnight in regional NSW is compared below on the basis of origin.

Incidence of Dispersal from Sydney to Regional NSW by Origin Market

Source: Tourism Research Australia. Domestic visitor estimates are yearly average over a 3 year base period – Year ending June 2009 to year ending June 2011. International visitor estimates are the year ending June 2011.

The research suggests that visitors more likely to disperse to regional NSW were those from Europe, the UK and North America. The research also found that apart from origin country dispersal was related to age and length of stay with younger visitors and those staying for longer more likely to disperse. Those travelling with a tour group were also found to be less likely to disperse.

Repeat visitation to Australia or Sydney was not a significant factor in relation to dispersal nor was main purpose of visit (VFR vs holiday / leisure).

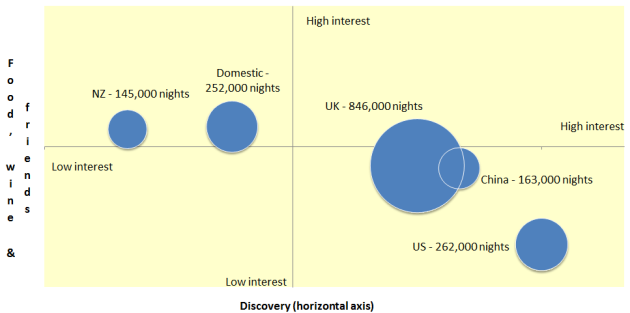

The chart below describes the size of the main disperser segments and also the motivational positioning.

Motivational Positioning by Origin Market

The size of each ‘bubble’ is proportional to the number of disperser nights for each market. Domestic visitor estimates are yearly average over a 3 year base period – Year ending June 2009 to year ending June 2011. International visitor estimates are the year ending June 2011.

The largest disperser segment which consisted of visitors from the UK was above average on the ‘Discovery’ dimension and around the average on the ‘Food, wine and friends’ dimension. The Chinese profile was similar to that of visitors from the UK. The US market was above average on ‘Discovery’ and well below average on ‘Food, wine and friends’.

Both the New Zealand and domestic visitors were below average on ‘Discovery’ and above average for ‘Food, wine and friends’.

The main barrier to regional dispersal was lack of awareness or salience rather than one of destination image[2]. In comparison to Victoria which has maintained a broadly based brand strategy over many years regional NSW may have been disadvantaged by the strength of Sydney as a world city and the focus on the ‘iconic’ attributes of Sydney in destination branding.

In April 2013 Qantas and the NSW Government announced a new $30 million partnership to promote Sydney and regional NSW to the world.

Destination NSW CEO, Sandra Chipchase, said, “Qantas customers will be able to enjoy the best that regional NSW has to offer, with a streamlined service on QantasLink, to a wide range of NSW destinations, including Albury, Coffs Harbour, Dubbo, Lord Howe Island, Port Macquarie, Tamworth and Wagga Wagga. Destination NSW and Qantas are working together to promote events and festivals across regional NSW, which visitors can easily reach using the QantasLink network.”

[1] Tourism Forecasting Committee, 2012. Forecast, issue 2. http://www.ret.gov.au/tourism/Documents/tra/Forecasts/2012/Forecast2012Issue2.pdf

[2] Trembath, R. 2008. Destination Salience. A model of consideration and choice for Australian holiday travel. Sustainable Tourism CRC. http://www.crctourism.com.au.